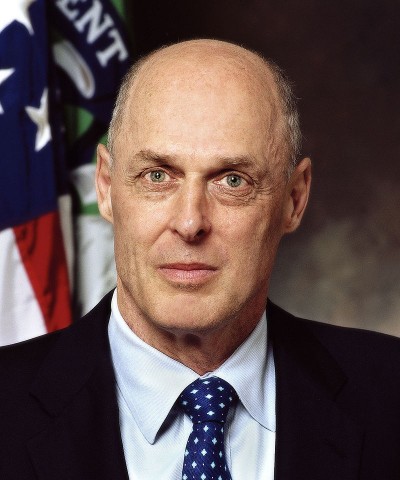

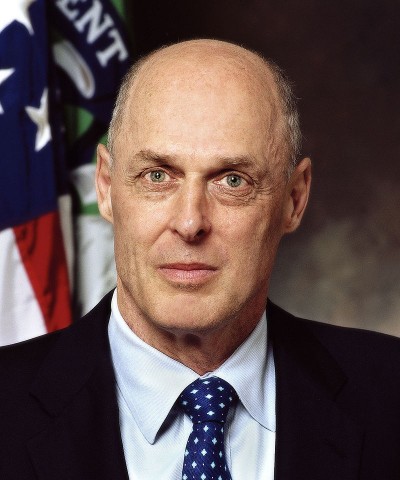

Former Goldman-Sachs President (((Henry Paulson))), presided as Chairman of SEC and key decision maker in

2008 meltdownNPR, “Is The Justice Department Shying Away From Prosecuting Corporations?” 11 July 2017:

TERRY GROSS, HOST: This is FRESH AIR. I’m Terry Gross. In an era of mass incarceration, why was only one top banker convicted after the financial collapse of 2008? My guest Jesse Eisinger tries to answer that question in his new book. Eisinger is an investigative business reporter with ProPublica. He shared a Pulitzer Prize for a series of stories on questionable Wall Street practices that led to the financial crisis. Lately he’s been writing about the Trump administration’s business and finance practices and policies. We’ll talk about that a little later.

Let’s start with his new book, which is subtitled “Why The Justice Department Fails To Prosecute Executives.” I can’t say the full title of the book because the FCC defines one of the words as indecent. It’s a word that begins with an S. So here’s the best I can do. It’s called “The Chicken S-Word Club.” The chicken word is a barnyard epithet for coward.

Jesse Eisinger, welcome to FRESH AIR. So question number one is, what were you thinking when you wrote a book with a title I can’t say on the radio?

JESSE EISINGER: (Laughter) Thanks so much for having me back. Yes, I should have thought about the interview before I came up with the title. But this comes from a line from Jim Comey. It’s a controversial title in my family. My daughters love it, which means my wife does not. But it actually comes from a speech. Now, you may know and your listeners may know Jim Comey from being recently fired by Donald Trump as FBI director. Before that, back in 2002, he became the U.S. attorney for the Southern District of New York, a role later held by Preet Bharara…

GROSS: Also fired by President Trump.

EISINGER: Also fired - the twofer there. And Comey comes in, and he’s replacing a legend in the office, Mary Jo White, who served as Obama’s SEC head. And he gathered all the hotshots from the Southern District. And the Southern District is the premier office of the Department of Justice. They are 94 offices around the country, U.S. attorneys from all over in every state. And the Department of Justice and - main justice is one of the prestigious units and then the prestige unit for corporate investigations and Wall Street and financial investigations is the Southern District.

Goldman-Sachs and 2008 swamp alumni, Gary Cohn and

Steve Mnuchin, drained into the Trump Administration.

And these guys really are the hottest shots, the best of the best of the best. And you know, if you have any doubts about them, you just have to ask them, and they will tell you how good they are. And they think of themselves as the best trial lawyers. And Comey gathers them all together and asks them, how many of you have never lost a case, never had an acquittal or a hung jury? And a bunch of hands shoot up. They’re very proud of their undefeated records. And he says, well, me and my buddies have a name for you guys. You guys are the chicken-blank club. And the hands go back down very fast.

And what was he trying to say there? Well, he was trying to say - and he goes on to explain that the prosecutor’s job - federal prosecutor’s job is not to win - like, win at all costs and preserve an undefeated record. What they’re doing is something more important. They are seeking justice. And to seek justice and ensure justice in this country, you have to take on ambitious cases. You have to raise your sights and look at the most significant wrongdoers in society and focus on them. And you can’t be afraid of losing and avoid those difficult cases if justice calls for taking on the powerful interests.

GROSS: Very inspiring pep talk - the premise of your book is, only one person was convicted after the financial meltdown of 2008. How did that happen? So who the one person who was convicted?

EISINGER: Well, there’s one banker, a kind of mid-level executive from Credit Suisse, a sort of second-tier bank on Wall Street. His name was Kareem Serageldin. And he was convicted of overseeing two traders who lied about the value of their portfolio of mortgage-backed securities - complex securities backed by home mortgages. And Credit Suisse seems to have turned him in. And he pled guilty and went to prison. He’s now out of prison. But he’s the one guy.

And I was deeply puzzled by how this could come to pass that the financial crisis could only result in one major conviction for someone doing directly things that related to the financial crisis. And so I wrote a story about it for The New York Times Magazine, and then that became this book.

GROSS: You write about how the Enron case was a turning point in how the Justice Department prosecutes these kinds of financial crimes, corporate crimes. So the Enron case seems to have been very successful. I mean executives of Enron went to jail. The accounting company that handled Enron was found guilty of crimes as well. Arthur Andersen is the name of the company. It was one of the big five accounting companies. So sum up for us some of the prosecutorial successes in the Enron case without getting too deep into the details of the case itself.

EISINGER: Sure. Well, the Enron case is the high watermark. And what I argue is that, you know, there’s never been a golden age where the rich and powerful who did something wrong really had to fear for their safety and were guaranteed to go to prison, but there have been silver ages. And the last high watermark was in the post-Nasdaq bubble-bursting era where we - the government prosecuted a number of companies and the individuals at all these companies, including Adelphia and WorldCom and Global Crossing and Tyco and Enron. Enron was the marquee fraud of that era 15 years ago.

And what the government did was something very different from what it did in the financial crisis. They assigned a task force. They brought individual prosecutors from around the country and FBI agents and assigned them just to the task force to prosecute this company. And if you remember, Enron was very close to the Bush administration, and yet the - his Department of Justice, to its credit, prosecuted without fear or favor. And they worked for years.

They - so one thing they did was they dedicated the resources. Two, they were very patient. Three, they worked up the chain. So they flipped low-level individuals. And that’s the way you have to prosecute complex corporate crime. Treat it something like a mob investigation where you flip the soldiers to get to the capos to get to the capo di tutt’i capi. And here you have to work painstakingly by turning lower-level individuals so that you can put them on the stand and they can say, I did something wrong, and so did my boss, and he’s sitting right there. And that’s the way they prosecuted the top two executives, Jeff Skilling and Ken Lay, successfully. They won the trial.

And my argument is that that wasn’t inevitable. There wasn’t a lot of direct evidence against those guys for doing something wrong. They had to have these people flipped and witnesses against them. And I think the Department of Justice has lost the skill and will to do the same thing. And I think Jeff Skilling and Ken Lay would not be prosecuted today by this Justice Department. But the high watermark was also the undoing for the Department of Justice because there was an enormous backlash after the Enron prosecutions.

GROSS: And that backlash was also aimed at the victory the Justice Department won against the accounting company Arthur Andersen, which was Enron’s accounting company and was in on the fraud. So what were the convictions like…

EISINGER: Exactly.

GROSS: ...At Arthur Andersen?

EISINGER: Yes. So this is - the undoing of the Department of Justice starts with the backlash against Arthur Andersen. Arthur Andersen was, as you say, Enron’s accounting firm and literally destroyed tons and tons of documents related to the Enron audit right before it was subpoenaed. But Enron had been subpoenaed. And the government was rightly outraged by this and started to investigate.

And Andersen’s activities were obvious. It looked very much like obstruction of justice. And they refuse to admit that they’d done anything wrong in the Enron case. And the government debated it and tried to settle with them and couldn’t because they demanded, quite rightly in my view, an admission of wrongdoing. And so the government felt like it had no choice but to bring Andersen, the firm, to trial. One executive pleaded guilty, and the government won.

But in the ensuing years, something remarkable happened - that it turned - the debate changed from a debate about accounting fraud and a recidivist and corrupt organization - which I think Arthur Andersen was - to a debate about the collateral consequences of indicting a large company.

In this case, many tens of thousands of workers were put out of work, which is clearly a tragedy and unfortunate. Unfortunately, my argument is sometimes companies need to go out of business if they are corrupt. But what happens is the Department of Justice learns the lesson that this was a bad prosecution, an overly aggressive prosecution, a cowboy prosecution. And they internalized the notion that they should never prosecute a large company again, which really ends up undermining their powers when it comes to corporate legal enforcement.

GROSS: So you think that that kind of, like, pulling back was the backdrop for the financial meltdown and how the prosecutions there were handled?

EISINGER: Yes. So that means - is they end up taking off, not literally - it’s not literal policy. But it’s effective policy of taking off the table the ability to indict a corporation when it’s done something wrong. And if you’re doing that, you only have settlement options. And what happens gradually is that settling becomes so attractive and so easy for prosecutors. They do over 400 of these kind of settlements called deferred prosecution agreements, DPAs, over the most recent decade compared to an insignificant number in the previous 10 years. And that becomes so attractive that they - two things happen. One is they don’t really want to indict companies. And two, they lose the focus on prosecuting individual executives. And they end up losing, I argue, the skill set to do it.

GROSS: Well, let’s take a short break here. And then I’m going to talk more about why the Justice Department fails to prosecute executives who are at fault. My guest is Pulitzer-Prize-winning business reporter Jesse Eisinger, who’s a senior reporter and editor for ProPublica and author of the new book “The Chickens Club.” And of course it’s not just chicken. There’s a chicken-blank-expletive in there to mean coward. OK, we’ll be right back after a break. This is FRESH AIR.

GROSS: This is FRESH AIR. And if you’re just joining us, my guest is Pulitzer-Prize-winning business reporter Jesse Eisinger, who’s a senior reporter and editor with ProPublica and author of the new book “The Chickens Club: Why The Justice Department Fails To Prosecute Executives.” And the book tries to answer the question, why were no executives punished with the exception of one after the financial meltdown of 2008?

So when you ask the question, why weren’t more individuals prosecuted, you know, after the financial meltdown, I expected the answer to be, well, there was this word that came down, like, protect the banks or, you know - that’s not what you found. It’s not…

EISINGER: No.

GROSS: Yeah, you found that - I mean the big picture I think is that you found that the Department of Justice lost a lot of prosecutorial tools that it used to have.

EISINGER: Yeah. The Department of Justice suffers a series of fiascos, losses. And they lose tools and there are bad rulings from the courts. And that ends up depriving the prosecutors of tools to prosecute these individuals. And they lose that focus and end up settling on corporations. So yes, it wasn’t Tim Geithner, the treasury secretary, calling up Eric Holder and saying, lay off the banks. It was a kind of slow evolution.

GROSS: What’s an example of a tool that you think could have been used to good effect after the financial meltdown that the Justice Department no longer was able to use?

EISINGER: Well, prosecutors used to be able to say to companies, if you want to claim that you’re cooperating with our investigations, then you have to waive your privilege and let us see all the evidence of wrongdoing at the company. And today, after the…

GROSS: Waive the attorney-client privilege.

EISINGER: Waive attorney-client privilege, exactly. They said they sort of enveloped the - themselves and protected themselves with attorney-client privilege. And companies used to have to waive that if they wanted to say that they were cooperating with government investigations. And after a big lobbying effort from the white-collar bar and corporations that fought - was fought over years behind the scenes in Washington, now the Department of Justice prosecutors can’t do that anymore. And that really deprived them of a very useful tool.

GROSS: Give us an example of the kind of information the Justice Department could get when it required a company or a bank to waive its attorney-client privilege.

EISINGER: They could get the full interviews that the company was having with executives about whether - when they were investigating wrongdoing. Now the lawyers can give summaries of them, little notes here and there. And it turns out that they’re going to inevitably kind of allide (ph) key details that might be very useful. And it gets even worse than that. Sometimes they don’t even tell the prosecutors who the names are of the people who are involved in the potential wrongdoing. It’s all sorts of information that’s vital to really understanding what really happened in one of these investigations.

GROSS: But isn’t attorney-client privilege kind of sacred in American law?

EISINGER: Well, it’s not in the Constitution. It is a common law practice that has grown up over hundreds of years - predates the United States. It is very important. And it’s a protection that each individual should have, and even corporations should have it in some point. But the Department of Justice needs to be less dependent on companies’ own law firms for these investigations so that if they’re not going to get access to privilege material from the companies cooperating, then they have to decide, well, we’re not going to be dependent on companies’ cooperation to conduct these investigations; we have to do it some other way.

GROSS: So you’re referring to instances where the corporation has hired a law firm to investigate itself when the corporation says, wrongdoing happened here; we’re going to get to the bottom of it. And they hire a law firm, and the law firm investigates. Is that what you’re talking about?

EISINGER: Yes. The dirty secret of American corporate law enforcement is that we have outsourced and privatized corporate investigations to the corporations themselves. We let the cartels investigate themselves about whether they’ve dealt drugs. And that of course is a deeply pernicious development and, I think, is a corrupting one.

GROSS: So when you’re talking about waiving attorney-client privilege, you’re referring to when a corporation has hired a law firm to investigate itself and then won’t tell the Justice Department what that law firm found.

EISINGER: Yeah. Often this is what happens - is that there’s some kind of scandal or some kind of investigation into a company like GM or Volkswagen or Uber or the major banks - JP Morgan, Chase. They’ll hire a major law firm like Debevoise and Plimpton or WilmerHale, these powerful law firms in New York and D.C. And those law firms assign dozens and dozens of associates and partners to comb through the company to figure out whether there was any wrongdoing. And then they deliver those results to the prosecutors. And the prosecutors flip through it and try to see if there’s any wrongdoing there.

Now, what happens is those investigations are studiously incurious about wrongdoing perpetrated by the CEO or chairman, as you can imagine. They - these law firms - sometimes they do very tough jobs investigating, but often they don’t because they’re not only worried about annoying their client, but they’re worried about their future revenue streams. If they do a tough job this once, other companies won’t hire them.

GROSS: So you think that having, say, investment banks settle for large fines is not an adequate punishment. Why not?

EISINGER: I don’t think it deters crime. And I think it undermines the sense of equity and justice in this country. I think people see companies paying big checks and the individuals getting away with it. And I think it stokes an enormous amount of anger with the system and undermines the legitimacy of our justice system, especially because we have a justice system which excessively punishes the poor and people of color while allowing top corporate executives, powerful people, off. We talk about inequality in this country, but I argue that the greatest perquisite of being powerful and wealthy in this country is the ability to commit crimes with impunity

GROSS: So another answer to the question of why was only one individual successfully prosecuted after the financial meltdown - you say, well, the Justice Department didn’t really go after individuals. Why not?

EISINGER: They didn’t prioritize it, and their reasons are complex and confusing. What happened was the Obama administration decided against creating a kind of task force to group individuals - prosecutors together and to give them just the sole priority of investigating the financial crisis. And because of that, the entrepreneurial offices around the country just followed their own incentives. So you had Preet Bharara in the Southern District of New York going after insider trading cases because those were easier and gathered him a lot of attention and media coverage instead of looking at the crimes in his own backyard of the financial companies.

GROSS: Is it hard to prosecute individuals?

EISINGER: Absolutely. It’s extremely difficult. Now, I don’t think that’s an excuse for Preet Bharara and Lanny Breuer and Eric Holder. They’re professionals, but their job is hard. There’s no question. But what that means is they have to give the proper incentives to prosecutors. Prosecutors have to be less afraid of losing. They have to be given the time and the resources. There’s been a resource stripping at the FBI and - of attention to white-collar crime. So they have fewer resources, and that has eroded the skill set. But there’s no question that this is difficult. The problem is that if you don’t do it, you have this lack of accountability, which really undermines people’s sense of fairness.

GROSS: My guest is Jesse Eisinger. His new book is called “The Chicken S-Word Club: Why The Justice Department Fails To Prosecute Executives.” After we take a short break, we’ll talk about how the Trump administration’s positions and practices are contradicting Trump’s populist rhetoric. And author Mat Johnson will talk about the aftermath of his computer crash in which he lost everything he wrote this year. I’m Terry Gross, and this is FRESH AIR.

GROSS: This is FRESH AIR. I’m Terry Gross back with Jesse Eisinger, an investigative reporter for ProPublica, who won a Pulitzer Prize for his reporting on questionable Wall Street practices that led to the financial crisis. His new book asked the question, why was only one executive convicted after the financial collapse of 2008? In investigating that, he examines the larger question of why the Justice Department so often reaches cash settlements with wrongdoing banks and corporations and fails to prosecute executives.

You know, it seems paradoxical that in an era of mass incarceration, it’s so hard to prosecute executives of corporations. Can you describe this, like, judicial timidity about prosecuting executives for corporate wrongdoing? So how do you explain that disparity?

EISINGER: Well, one thing is that there’s a kind of class affinity here where I think that prosecutors have an easier time certainly prosecuting drug dealers and murderers but also prosecuting corrupt politicians. I think they see politicians, and it kind of disgusts them when they do corrupt things. But when they see an articulate, well-educated executive from the same schools that they went to or the parents of the - their classmates, they find it much more difficult to picture these people as criminals.

As one SEC regulator put it in an email when they were investigating Goldman Sachs for wrongdoing - he said these are good people who have done one bad thing. And they essentially view executives as good people who may have made a mistake, and they don’t want to put those people in prison. Suffice it to say, they don’t see young black males who are dealing drugs as essentially good people making one bad mistake.

The other problem is that the courts are much friendlier and judges are much friendlier to corporate criminals than they are to street criminals. So we have a divided society, which is no surprise to anybody. And it really manifests itself in criminal law enforcement.

GROSS: Are we seeing a double standard develop about what a corporation is - because in some instances, a corporation is a person. Like, when it comes to giving money to a campaign, a corporation is now a person. But does a corporation have a different standing when it comes to being prosecuted?

EISINGER: It does because the Department of Justice has effectively decided that it will not indict this kind of person, the corporate person. And it’s not an official policy. It’s just an effective one. And because of that, corporations have the ability to settle for money and never face the death penalty, never face serious indictment. And because of that, they can get away with a lot of wrongdoing for a long time without paying any serious penalty besides writing a check. And the checks are something that they can afford and something that comes out of not their pocket but the shareholder pockets.

GROSS: So you’ve been writing - in addition to writing this book, you’ve been writing about issues pertaining to the Trump administration. What have you been focusing on?

EISINGER: Well, most recently we were focusing on President Trump’s personal lawyer, Marc Kasowitz, who runs a firm in New York that specializes in civil cases, suing big banks, things like that. But he’s been President Trump’s personal lawyer for 15 years. And most recently, we wrote a story about how he had played a role or has been bragging about playing a role in the firing of Preet Bharara.

Trump’s attorney, (((Marc Kasowitz)))

GROSS: And Kasowitz, Trump’s lawyer, represented him in the failed lawsuit against a journalist, in the Trump University case and candidate Trump’s response to allegations of sexual assault by multiple women last year. He’s his personal attorney in the Russia investigation. So he was bragging that he’s the one who got Preet Bharara fired. Preet Bharara was the U.S. prosecutor in the Southern District of New York, which is the district that oversees Wall Street.

EISINGER: Exactly. So yes. Now, it’s a little unclear exactly what happened. But we do know is that Kasowitz has been telling people that he’s the one who told Trump to fire Preet and fire Preet because Preet was going to get them.

GROSS: That Preet was going to go after Trump?

EISINGER: Yeah, that Preet was too dangerous for Trump to keep in his position. And to Preet’s credit, I don’t think he went after Wall Street very aggressively, but he did go after powerful politicians in New York. And so he is viewed - and he is an aggressive prosecutor in at least one realm. And so Kasowitz was sort of foreseeing that he could turn on Trump even though - and Trump had a very unusual meeting in - at Trump Tower where he promised Preet could keep his job.

And then one of the great mysteries was why Trump turned and decided to fire Preet. As you said, he fired Yates, and he fired Jim Comey. He also fired Preet Bharara. And the question is, why? And this may answer it - which is that he was worried about some kind of investigation that the Southern District was conducting.

There is an investigation that my colleague Robert Federici broke at ProPublica into Tom Price, Trump’s health and human services secretary, who is being investigated for questionable insider trading in a biotech stock. So that may be what was happening. We don’t really know what the connection was. But there was clearly some reason why Preet was abruptly fired.

GROSS: If Kasowitz is still Trump’s lawyer, why would Kasowitz brag that it was his idea to have Trump fire Preet Bharara?

EISINGER: Well, people do funny things. Kasowitz is known among his friends and acquaintances as a guy who likes to talk about his accomplishments, sometimes exaggerating them. And so he’s a big talker and likes to put himself at the center of the action.

GROSS: One of the things you started writing about after President Trump took office was his freezing of regulations. So what regulations has he been freezing up? Give us the big picture.

EISINGER: Yes, all sorts of corporate regulations that the various Obama administration agencies were working on - working toward but hadn’t quite finished. They were in process. And the Trump administration, in one of its first actions, froze almost all of them - dozens and dozens of rules, rules about health and safety and protection for children, bad products that could cause cancer, unsafe work conditions, things like that. And subsequently they’ve been rolling back regulations with the help of industry all across the agencies. It’s been a big rollback from the Obama administration’s activities.

GROSS: Ok. If you’re just joining us, my guest is business journalist Jesse Eisinger, author of the new book “The Chickens Club: Why The Justice Department Fails To Prosecute Executives.” He writes for ProPublica. We’re going to take a short break, and then we’ll be right back. This is FRESH AIR.

GROSS: This is FRESH AIR. And if you’re just joining us, my guest is business journalist Jesse Eisinger. He’s a senior reporter and editor for ProPublica. He won a Pulitzer Prize for his reporting. His new book, “The Chickens Club,” is about why the Justice Department fails to prosecute executives and what the implications of that are.

So your book is so much about the Justice Department and how it does or doesn’t go after individual executives and corporations who are suspected of major wrongdoing. The new attorney general under President Trump is Jeff Sessions. Have you written about him? And how does he figure into your perceptions of what the Justice Department is or isn’t doing now in terms of corporate crime?

EISINGER: Well, the early signs are not good. Jeff Sessions - I’ve been a big critic of Eric Holder, and I imagine that Jeff Sessions is going to be an order of magnitude worse about corporate law enforcement. I think the best-case scenario is there is just going to be a lot of neglect, which means that companies will be able to commit crimes and do bad things without fear that they’re going to really be prosecuted.

There are worst-case scenarios, which is that the Justice Department becomes an agent to punish enemies of the Trump administration and reward friends. And we’re already seeing glimmers of that possibility in the antitrust enforcement, which is not exactly criminal law enforcement although there are crimes that can be committed in antitrust. But we’re seeing threats for mergers - against mergers of enemies - of perceived enemies of the Trump administration, like CNN.

GROSS: What’s that story, with the CNN story?

EISINGER: Well, what - so CNN is a subsidiary of Time Warner, and Time Warner wants to merge with AT&T. And the Justice Department oversees merger enforcement and allows certain mergers to go through. And this is a relatively - it’s supposed to be apolitical. You’re supposed to allow mergers to go through that are good for the economy and disallow ones that are bad for the economy.

But Trump doesn’t like the way CNN covers him, as we all know, very famously. And so now there’ve been some threats, some implication that if CNN doesn’t make some changes, then perhaps the merger might have some problems. Nice little merger you got here - shame if anything happened to it. That would be extremely dangerous. It would take us back over a hundred years and put in this kind of political meddling that really would pervert law enforcement in the United States. That should be aggressively countered and resisted by the Jeff Sessions DOJ, and we just don’t know if it’s going to be. But the early signs unfortunately are not great.

GROSS: So what has Trump said or done regarding the merger?

EISINGER: Well, Trump, during the campaign said he didn’t think the merger should go through and also criticized CNN. Most recently, The New York Times reported that White House officials are going to try to put some pressure on CNN to get rid of Jeff Zucker, the head of CNN - Time Warner to get rid of Jeff Zucker - and maybe use the merger as leverage.

Trump has also criticized Amazon because he doesn’t like the coverage of The Washington Post, which is owned by the head of Amazon, Jeff Bezos. And Amazon is now in - seeking to take over Whole Foods. And so that merger could potentially run into problems based on the Washington Post’s critical coverage of Trump. If those things come to pass, we really are in a different place in American jurisprudence than we were maybe ever in certainly in my lifetime.

GROSS: Elaborate on that last thought for us.

EISINGER: Well, if Trump starts to use the Department of Justice to reward friendly corporations and to punish enemy corporations or perceived enemy corporations, then we’ve perverted the notion that there’s a fair justice system or a impartial justice system, that it’s a rule of law. And suddenly we’re into a kind of cronyist (ph) autocratic system where companies that are - can seek favors and rewards by being friendly to the administration. That is not the system we’ve lived in previously.

GROSS: Has President Trump been rolling back regulations pertaining to Wall Street?

EISINGER: Yes. The - they’re moving on two fronts. One is that his officials have sent edicts down to the heads of the various regulatory bodies - the Office of the Comptroller of the Currency, the Federal Reserve, the SEC - that they want a lighter hand in regulation. And what that will mean is there’s - you know, there’s an enormous amount of discretion at these agencies about what kinds of rules they enforce and how they enforce them. And so they’re going to use that discretion to be - have a much lighter hand.

And the second front is that they’re going to try to roll back legislation - regulation through legislation and try to pass that. That’s going to be a more difficult thing to get passed especially because the Republican-controlled Congress is not a smooth-running machine, as we’ve all seen. So they may not succeed in rolling back the Dodd-Frank financial reform at least in its entirety. But they are going to chip away at it and maybe undermine it to the point of meaninglessness.

GROSS: You know, you’ve written that you think President Trump as candidate Trump really rode the anger against Wall Street and that the pro-Trump movement is in part a result of the financial meltdown of 10 years ago. So how does that compare to what he’s actually doing as president?

EISINGER: Well, yes. I think that it fueled Trump and undermined Hillary Clinton. You know, Hillary Clinton gave those speeches to Wall Street and Goldman Sachs. And people thought, she’s in the hand - pocket of the banks, and here he was attacking Goldman Sachs. And I think that people were very angry primarily about the lack of individual accountability. They saw for their own eyes that nobody went to prison, and I think they viscerally thought that that was wrong.

Gary Cohn, another Goldman-Sachs alumni class of 2008, is now Trump’s Chief Economic Advisor (even though Trump ran under the guise of “draining the swamp”).

Gary Cohn, another Goldman-Sachs alumni class of 2008, is now Trump’s Chief Economic Advisor (even though Trump ran under the guise of “draining the swamp”).

And Trump took advantage of that and attacked Hillary Clinton for being in the pocket of Wall Street and especially Goldman Sachs. Then he turns around and astonishingly betrays those voters by installing multiple Goldman Sachs executives into the most powerful positions - treasury, secretary, his head economic adviser, Gary Cohn - into office. It’s a stunning reversal. And it seems like his supporters have been betrayed. But it’s not clear whether they feel betrayed.

GROSS: So you’re a business journalist. And in your position at ProPublica, you do investigative work. And you have a lot of discretion about what stories you’re going to go after. It’s not like you cover on a certain beat every day. You’re not doing daily reporting. How do you decide what you want to investigate - because once you go after a story, you’re going to be putting a lot of time into it.

EISINGER: Yeah. That is the trick of investigative reporting. And it’s the luxury we have, but it’s also the most difficult thing. And so we are very careful about what kinds of stories we want to dig into. We’re looking for the wrongdoing and to hold the most powerful entities that we can accountable. So we look at the subject matter and see if there’s real pain from individuals and see if this is an entity that matters.

And now we’re focused a lot on the Trump administration. We have devoted an enormous amount of resources - shifted away, in some cases, from other stories that we’ve thought were less important and less vital to look at what this administration is doing across a variety of areas in labor, in immigration, in environmental protection and in law enforcement.

And the reason we’re doing that is because this administration is so different from the administrations that have come before us. Even a corporate-friendly administration like the George W. Bush administration pales in comparison to what we’re seeing now with the Trump administration. And so ProPublica has decided to dedicate a lot of resources to trying to expose the powerful and trying to expose the truth. It’s not easy. We hope we’re doing a decent job, but that’s what we feel our obligation is.

GROSS: Do you think that the conflict between Trump and the press is kind of permanently changing journalism?

EISINGER: You know, I would hope that this notion that the government is something to be skeptical of and that when the press is - needs to be appropriately adversarial will stay even if we get an administration like the Obama administration. I think the press was too friendly to the Obama administration because they were buttoned-down and technocratic and articulate and serious-minded and well-educated. And so I think the press often was not skeptical enough. So if there is one thing that is good that comes of the Trump administration, maybe it is that it installs a kind of permanent rediscovery of our adversarial role, which is vital to democracy.

GROSS: Jesse Eisinger, thank you so much for talking with us.

EISINGER: Well, thank you so much for having me. This has been great.

GROSS: Jesse Eisinger is a senior reporter and editor at ProPublica and author of the new book “The Chicken S-Word Club: Why The Justice Department Fails To Prosecute Executives.”

Former Goldman-Sachs President (((Henry Paulson))), presided as Chairman of SEC and key decision maker in 2008 meltdown

Former Goldman-Sachs President (((Henry Paulson))), presided as Chairman of SEC and key decision maker in 2008 meltdown Trump’s attorney, (((Marc Kasowitz)))

Trump’s attorney, (((Marc Kasowitz)))

Posted by Gary tax Asia to pay for black welfare Cohn on Thu, 10 Aug 2017 06:34 | #