Fixing Hubbert Linearization

Peak oil curves are largely based on a model called Hubbert Linearization. Some critics claim that this model is incorrect. The fix may be as simple as assuming a slight positive skew on the production curve.

Here is the Hubbert Linearization for oil production in the Lower 48 United States:

You’ll notice that although the latter data points appear very linear, the early data points are grossly underestimated. What could explain this? Well, let’s look at the production curve upon which it is based:

Notice that errors of the normal curve model are systematic. The early, high positive curve part consistently overestimates. The positive slope, consistently underestimates. The negative slope consistently overestimates. We can see the beginnings of the high positive curve tail part underestimating the actual end-game production.

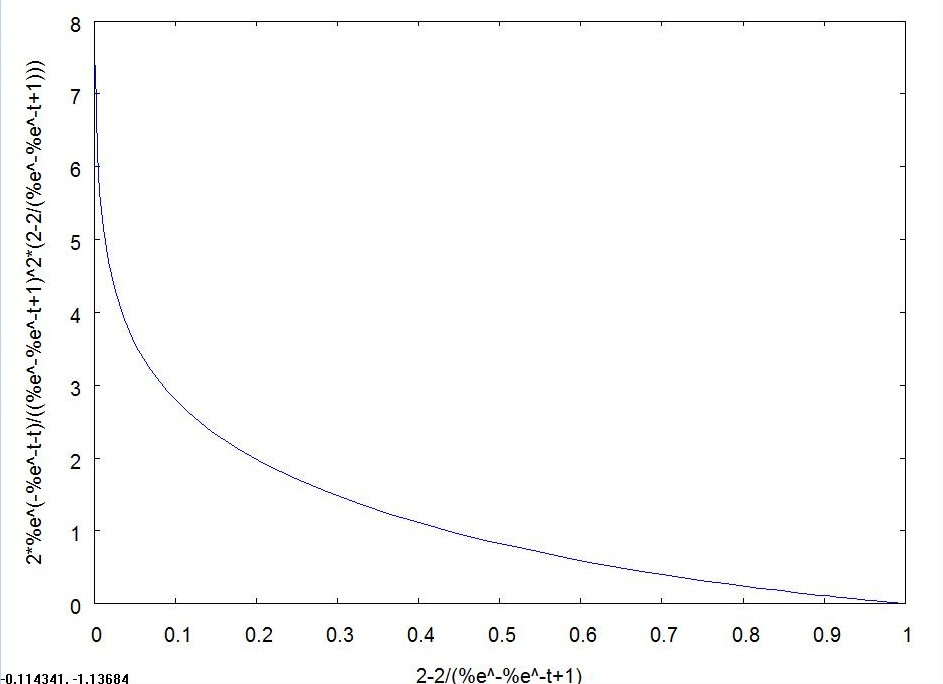

If so, we can place a positive skew on the production curve to get a curve that may be more realistic:

There may be additional corrections required in the other major moments (more kurtosis, for example), but they won’t affect the overall prediction:

Peak oil is real (under its assumption of geological fluid recovery) and, Hubbert Linearization is understimating the terminal production.

Bottom line: There may be a little more “breathing room” than predicted by normal peak oil theory.