Dollar Rises, Treasuries Fall as Fed Raises Rates

Bloomberg, “Dollar Rises, Treasuries Fall With Stocks as Fed Raises Rates”, 14 Dec 2016:

- FOMC lift interest rates for only second time since 2006

- Officials signal steeper path for borrowing costs in 2017

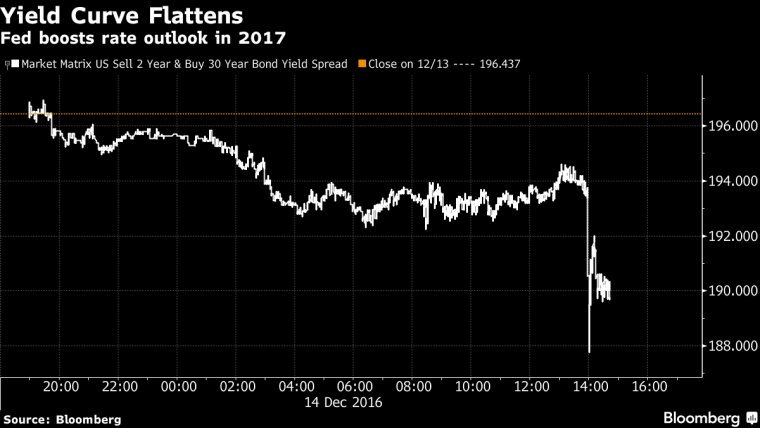

The dollar rose and two-year Treasury yields reached the highest in seven years as the Federal Reserve signaled a steeper path for borrowing costs in 2017 after raising rates for the first time this year.Stocks pared declines as Chair Janet Yellen said changes in rate projections were ‘very modest.’

“The bottom line is that this is more hawkish than the markets expected,” said Dennis Debusschere, a senior managing director and global portfolio strategist at Evercore ISI in New York. “I don’t think the shift higher in the dots was priced in. The consensus going in was that they’d wait until they had details of the fiscal program before they actually raised the rate forecast, and they did that before they saw the details.”

The Fed’s path to tighter monetary policy has been delayed throughout 2016, as first instability in Chinese markets, then the shock votes for Brexit and Trump, put policy makers on the defensive. After Wednesday, traders see a two-in-three chance of additional rate increases from the Fed by June, futures show.