|

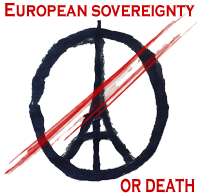

[Majorityrights News] 4 minutes and 43 seconds of drone warfare history - updated Posted by Guessedworker on Wednesday, 04 June 2025 16:50. [Majorityrights Central] An approaching moment of Russian clarity Posted by Guessedworker on Sunday, 11 May 2025 12:34. [Majorityrights Central] “It’s started. You ignored us. See where it’s going to get you.” Posted by Guessedworker on Sunday, 04 May 2025 00:42. [Majorityrights News] Another dramatic degradation of Russia’s combat capacity Posted by Guessedworker on Wednesday, 23 April 2025 08:49. [Majorityrights Central] A British woman in Ukraine and an observer of Putin’s war Posted by Guessedworker on Monday, 14 April 2025 00:04. [Majorityrights News] France24 puts an end to Moscow’s lie about the attack on Kryvyi Riy Posted by Guessedworker on Monday, 07 April 2025 17:02. [Majorityrights News] If this is an inflection point Posted by Guessedworker on Thursday, 03 April 2025 05:10. [Majorityrights News] Sikorski on point Posted by Guessedworker on Friday, 28 March 2025 18:08. [Majorityrights Central] Piece by peace Posted by Guessedworker on Wednesday, 19 March 2025 08:46. [Majorityrights News] Shame in the Oval Office Posted by Guessedworker on Saturday, 01 March 2025 00:23. [Majorityrights News] A father and a just cause Posted by Guessedworker on Tuesday, 25 February 2025 23:21. [Majorityrights Central] Into the authoritarian future Posted by Guessedworker on Friday, 21 February 2025 12:51. [Majorityrights Central] On an image now lost: Part 2 Posted by Guessedworker on Saturday, 15 February 2025 14:21. [Majorityrights News] Richard Williamson, 8th March 1940 - 29th January 2025 Posted by Guessedworker on Monday, 03 February 2025 10:30. [Majorityrights Central] Freedom’s actualisation and a debased coin: Part 2 Posted by Guessedworker on Saturday, 11 January 2025 01:08. [Majorityrights News] KP interview with James Gilmore, former diplomat and insider from first Trump administration Posted by Guessedworker on Sunday, 05 January 2025 00:35. [Majorityrights Central] Aletheia shakes free her golden locks at The Telegraph Posted by Guessedworker on Saturday, 04 January 2025 23:06. [Majorityrights News] Former Putin economic advisor on Putin’s global strategy Posted by Guessedworker on Monday, 30 December 2024 15:40. [Majorityrights News] Trump will ‘arm Ukraine to the teeth’ if Putin won’t negotiate ceasefire Posted by Guessedworker on Tuesday, 12 November 2024 16:20. [Majorityrights News] Olukemi Olufunto Adegoke Badenoch wins Tory leadership election Posted by Guessedworker on Saturday, 02 November 2024 22:56. [Majorityrights News] What can the Ukrainian ammo storage hits achieve? Posted by Guessedworker on Saturday, 21 September 2024 22:55. [Majorityrights Central] An Ancient Race In The Myths Of Time Posted by James Bowery on Wednesday, 21 August 2024 15:26. [Majorityrights Central] Slaying The Dragon Posted by James Bowery on Monday, 05 August 2024 15:32. [Majorityrights Central] The legacy of Southport Posted by Guessedworker on Friday, 02 August 2024 07:34. [Majorityrights News] Farage only goes down on one knee. Posted by Guessedworker on Saturday, 29 June 2024 06:55. [Majorityrights News] An educated Russian man in the street says his piece Posted by Guessedworker on Wednesday, 19 June 2024 17:27. [Majorityrights Central] Freedom’s actualisation and a debased coin: Part 1 Posted by Guessedworker on Friday, 07 June 2024 10:53. [Majorityrights News] Computer say no Posted by Guessedworker on Thursday, 09 May 2024 15:17. [Majorityrights News] Be it enacted by the people of the state of Oklahoma Posted by Guessedworker on Saturday, 27 April 2024 09:35. [Majorityrights Central] Ukraine, Israel, Taiwan … defend or desert Posted by Guessedworker on Sunday, 14 April 2024 10:34. [Majorityrights News] Moscow’s Bataclan Posted by Guessedworker on Friday, 22 March 2024 22:22. [Majorityrights News] Soren Renner Is Dead Posted by James Bowery on Thursday, 21 March 2024 13:50. [Majorityrights News] Collett sets the record straight Posted by Guessedworker on Thursday, 14 March 2024 17:41. [Majorityrights Central] Patriotic Alternative given the black spot Posted by Guessedworker on Thursday, 14 March 2024 17:14. Majorityrights News > Category: Business & Industry When this tweet speaks of “the socialist party” it is speaking of a party that would not delimit social accountability to native interests first and foremost. When this tweet speaks of “the socialist party” it is speaking of a party that would not delimit social accountability to native interests first and foremost.The sane management of pervasive ecology has been dealt yet another serious blow as a central element, the management of human ecology through the accountability that ethnonationalism provides, has been pushed aside - at least temporarily - by liberal internationalist interests. Matteo Salvini’s crucially necessary nativist, ethnonationalist anti-immigration platform has been sidelined by a coalition of the 5-Star Party, which is in cahoots with foreign interests and the corporate internationalist sell-out, Giuseppe Conte, reinstalling him as Prime Minister; allowing him to continue his border liberalization policies which are destroying Italy, Italians and European peoples broadly. Italy’s corrupt Five-Star Movement announced Wednesday that it had made a deal with the Liberal Party to form a coalition government — keeping Prime Minister Giuseppe Conte in place while avoiding elections and ousting the ethnonationalist League led by Matteo Salvini. Conte’s position was strengthened this week when President Trump, who pretends to share a similar vision on immigration to Salvini, tweeted his support of Conte – calling him a “very talented man who will hopefully remain Prime Minister!” Showing his true colors form the start, Trump shunned a meeting with Salvini, who was prepared to endorse him as Trump campaigned for the Presidency. While Salvini was able to gain popular support by broadening his party’s platform from Lega Nord, to one that represents all of Italy, he sought to gain elite support along with the 5-Stars and Conte’s party by joining the ass-kissing of the Kremlin, the Knesset and the Trumpstein agenda.  Salvini might have added Trumpstein, Putin and Netanyahu to the list of people not to trust with native European interests. Salvini might have added Trumpstein, Putin and Netanyahu to the list of people not to trust with native European interests.And with friends like that, highly practiced in the art of treachery, the message is: lay down with dogs and wake up with fleas. Rather, wake up sidelined by the truly corrupt - corrupt enough to push aside your crucially necessary anti-immigration, nativist position and sell out your people and their ancient birthright.

The #FiveStarMovement & the [liberal] party have reached an agreement to form government

Ergo, maybe you can ‘weenie the Salvini’...

I don’t even like throwing a bone to the Jewish ass-kisser Trump, or candidates from either party (Democrats either, of course) of America’s utterly baked-in and controlled liberal system - wherein “conservatives” only conserve liberalism. However, even if Trump was forced to address this issue to push back against (((Social Media Bias))) in favor of the Democrats in the coming election, and even if the examples of censorship are not those with platforms that I agree with (for example, a pro-life platform excluded from Twitter), the issue and the fact of censorship and “popularity” being manipulated, brought out into open awareness and discussion from underneath the gaslighting by (((social media))) is helpful. As ethnonationalists, you may not like the examples of people and issues censored. On the other hand, just as raising the issue of censorship itself provides some daylight for our concerns, so too the intersectionality that a David Horowitz experiences in his example of social media censorship provides some grounds for us to seize upon. Yes, Horowitz has concerns for intersectionality against (((his interests))) in mind, ultimately (no small matter, he’s not “one of us and on our side”); nevertheless, he’s the one who spilled significant beans on the who, what, how of Cultural Marxism/Political Correctness that allowed William Lind to articulate the matter so well for purposes of our ethnonationalist critique and increased freedom from its voodoo.

Page 7 of 26 | First Page | Previous Page | [ 5 ] [ 6 ] [ 7 ] [ 8 ] [ 9 ] | Next Page | Last Page |

|

Existential IssuesDNA NationsCategoriesContributorsEach author's name links to a list of all articles posted by the writer. LinksEndorsement not implied. Immigration

Islamist Threat

Anti-white Media Networks Audio/Video

Crime

Economics

Education General

Historical Re-Evaluation Controlled Opposition

Nationalist Political Parties

Science Europeans in Africa

Of Note MR Central & News— CENTRAL— An approaching moment of Russian clarity by Guessedworker on Sunday, 11 May 2025 12:34. (View) Piece by peace by Guessedworker on Wednesday, 19 March 2025 08:46. (View) Into the authoritarian future by Guessedworker on Friday, 21 February 2025 12:51. (View) — NEWS — If this is an inflection point by Guessedworker on Thursday, 03 April 2025 05:10. (View) Sikorski on point by Guessedworker on Friday, 28 March 2025 18:08. (View) CommentsGuessedworker commented in entry 'Militia Money' on Mon, 19 May 2025 16:32. (View) James Bowery commented in entry 'Militia Money' on Sun, 18 May 2025 16:07. (View) Guessedworker commented in entry 'Militia Money' on Tue, 13 May 2025 23:10. (View) James Bowery commented in entry 'Militia Money' on Tue, 13 May 2025 16:31. (View) Guessedworker commented in entry 'Militia Money' on Tue, 13 May 2025 00:16. (View)

|